BUYER RESOURCES

There are typically two very common ways property owners can successfully exit without paying a large sum of money (up to 40% taxes on the capital gains).

What are the benefits of 'seller carry financing'?

- Provides you, the seller, with the ability to Defer Capital Gains Taxes by spreading out your tax liabilities

- Guarantees the seller interest payments and payout using your property as collateral

- Mortgage Interest Deductions

- Guaranteed Monthly Income for the Term with zero Management responsibilities

- Exit Plan now Guaranteed

- Bank Financing will require a more thorough investigation, taking a deeper dive into your documents and expenditures including income and taxes – if you don’t have that properly prepared the Lender will definitely be more conservative then what I, the buyer, can recalculate

- Typically Less of a hassle for you, the Seller – reduces stress on you, the seller, to reinvest immediately

- Closing Costs for both parties are far more attractive

- Certainty and Faster of Close of Escrow

- Higher Interest rate for seller than bank CD or Money Market, Increase in your Net Return

- Seller Finance can provide an “annuity” vs. Cash at Close

- If we default, you get to take your Park back

- Passive Income for x amount of years – you’re not locked into a 1039 for moving the money and avoiding tax penalties

- A way for you to pay it forward to the next younger round of investors who started off similarly to where you did

- Provides a flexible structure – whatever works for both you and I – also, if you decide want out of the deal later, you can always sell the note for cash

- Gives us the ability to get you closer to your Asking Price

WHAT ARE THE TWO WAYS A SELLER CAN 'CARRY' THE SALE ON THEIR MHP?

1. Seller Financing

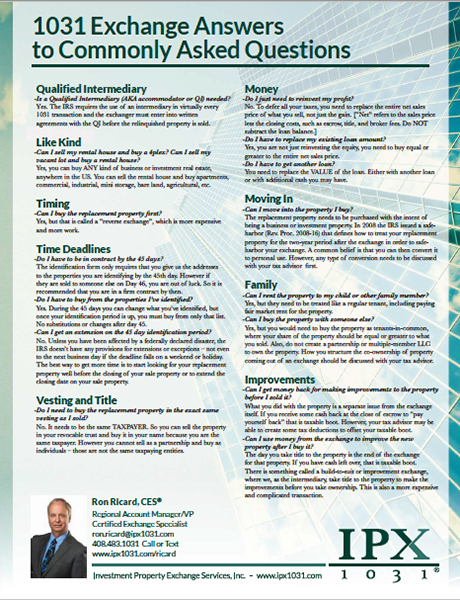

2. 1031 Exchange

These are the most common ways when the opportunity presents itself.